Worried that mortgage interest rates are too high to buy a home or make an investment? Concerned that housing and investment property prices are too high? This article is about perspective. Read on to discover that all is not doom and gloom. Many people have found ways to afford homes in this type of economy, we will show you how.

Don’t think this is the first time we have had a situation with high mortgage interest rates and high housing rates. It has happened in the past and people worked around it. That’s the point of this article, we want to guide you past the roadblocks. Be prepared to improve your outlook on buying that house or making that investment.

Starting with mortgage interest rates

Did you know that mortgage interest rates today are close to the average rate from 1972 through 2024? The past 40 years have produced interest rates as low as 2.78 (average U.S. rate) in 2021 and as high as 18.28% in 1981. In 1981 many people had to buy houses with adjustable-rate mortgages more often than 30-year fixed-rate loans.

For nearly a decade rates were in the 7-8% range and people bought houses and investors invested. Higher mortgage rates occur often as 30-year rates react to economic cycles. Check out the FreddieMac graph below which shows you the historic trend. Every few years there is a high and then a low. “What comes up must come down” scenario.

The average interest rate has been dropping for a few decades until the lowest rate happened last year. As you can see from the graph, interest rates will likely dip in the near term.

The current rate climb is not unique, it has happened before

Higher interest rates in August 1981 at 12% went as high as 18.28% then back down to 12% in about 2.5 years. That is a very large increase and a very large decrease. Higher rates will probably top out and drop to a lower rate in a similar period. If you think all of the civil unrest of the past two summers and other major events even COVID will prevent the cycle from repeating itself, then you need to study more.

There is much political turmoil now, from high oil prices (not near historic highs when adjusted for inflation) to catastrophic natural disasters e.g. Florida. History indicates that similar events affected the economy in the past.

Recommendations to prepare for this current economy

Your decision to invest or buy a home should be based on the facts, not fear. You can do the following to put yourself in a good position to be a buyer in this economy:

- Pay your credit debt on time every time

- Pay off your credit card balances which will only be more difficult as interest rates will rise with inflation and the FED rates. Do not run balances, use the cards and pay them each month.

- Clean up your credit, get that score into the mid 700s

- Don’t give up any credit cards. Assign a small monthly recurring bill to each e.g. mobile phone bill and set them for autopay.

- Investors must raise rents to market or above market and do it now. The value of your property depends upon it.

- Investors and homeowners should maintain their homes, and fix anything that can affect the value

- Accumulate cash (except for paying off credit cards). Open short-term CDs if you intend to invest in six months to one year. Some CDs are paying 3%+

- Don’t buy a car, boat, or RV now if you plan to buy property in the next year. You should conserve cash and reduce your debt-to-income ratio

- Sell everything you own that you do not use or need. Time for a garage sale, sell that old boat. Convert these assets to cash.

- If you are considering relocation, look at interest rates by state, they vary. CA – 6.17% vs MS – 5.9% for a fixed 30-year mortgage (at the time of this writing).

More than ever, it’s time to get educated about mortgage loans. This is just one element in an overall strategy to buy your next house or investment property. There is no need to wait for that time when the average mortgage rate is at rock bottom or home prices decline further to the bottom.

Very few people with lots of education and experience can judge the bottom of any of the past cycles. Waiting will cause you to bypass opportunities. Yes, you want a lower interest rate and yes you want to buy a new home at a reduced cost.

Lots of mortgage loan programs

Mortgage loans come in all sizes and colors. No two loan brokers are offering the same packages. You need to shop around and that means with more than one mortgage broker. Of course, include referrals in your search but don’t ignore other mortgage brokers who specialize in the package you need.

Use the comparison form below. This form will permit you to compare three mortgage brokers’ loan costs plus the interest rate. During the past few years, interest rates were so low that there was little need to shop around. When rates are at 3% the difference between one and another broker was very small.

It’s time now for some serious hunting. Include credit unions, local banks, and independent mortgage brokers. It’s about loan options, not just interest rates. Also, can the lender get you closed? Those upfront costs add up and when you consider the total of all closing costs, that low down that was promised may not look so good.

During the past few years, most people were looking for a fixed rate at least for their primary residence. Variable/adjustable rates and many other types of programs are now being “reintroduced”. I recall when lenders were very creative when interest rates were in the 8-10% range.

Government-backed programs can help

There are many government-backed loans for single-family homes. One such program on the Mississippi Gulf Coast is a zero down payment, zero mortgage insurance loan if you buy a property in a majority-minority area. There are other zero down payment products but eliminating the PMI/MIP is a great deal.

Rural areas have access to USDA loans with down payment assistance. There are programs for first-home buyers with low down payment requirements.

Investors are starting to look hard at commercial loans based on the value of the property. These loans do not rely on personal credit except for qualification and the lenders do not report these mortgages to consumer credit agencies. This is where your solid credit and cash reserves can land a great loan program.

Adjustable-rate mortgages are an option for investors as are HELOC loans which were out of favor with lower interest rates. Loan terms for commercial loans are different than for residential mortgage loans. Investors can choose programs based on their objectives. If for example, an investor wants to buy a duplex and live on one side, they can obtain 30-year mortgage rates that are more favorable than a commercial loan for the same purpose.

Excellent credit history is the key

Back to your financial situation. I can not stress enough the value of a good credit history at this time more than ever. Lenders are already quietly tightening things to prevent a reoccurrence of the 2009 collapse of the housing market. The Federal Housing Administration and Fannie Mae (the agency that buys loans from lenders) have issued guidelines that require even a first-time homebuyer to meet two basic requirements.

First, they must have a good credit score. Scores vary depending on the program. Second, they must not have debt that exceeds the percentage of income for the stated program e.g. 40%.

There is a third requirement for some programs and that is, the buyer must prove they have funds to cover closing costs. Closing costs for the type of loan you are applying for will usually include a down payment, pre-paid interest, insurance, property taxes, and a percentage of recurring costs e.g. taxes and insurance to fund the escrow account.

Compare monthly payments by credit score

Investors may have to produce between three to six months reserves of all costs e.g. mortgage, taxes, insurance, PMI, and other recurring monthly costs. Continued market conditions will dictate how the parameters for mortgage loans will change over time.

To partially mitigate higher interest rates, your excellent credit can help a great deal. Check out the chart below which gives you an idea of the difference between the rate you would pay at X credit score and what you would pay at a higher score.

The chart below indicates the monthly payment difference based on interest rates. The purpose of that chart is to emphasize the importance of the amount you pay for insurance and other costs and how working to reduce those costs will have an impact on the payment amount you pay each month.

Note: The rates listed were the national average at the time this was written. This calculator will provide the approximate differences. To gain accurate information you must update the rates. You need not update the rates if you are just trying to see what happens at different credit scores just don’t use the results without correcting the rates.

How can I reduce the interest rate?

We will get into other things such as your credit score which are entirely within your control. You can make a significant difference in the final interest rate by following our suggestions. I want to show you actual examples of how your efforts can help reduce the effective interest rate on a purchase.

If you want to watch the rates for a while, look at the federal funds rate, one of the main factors that affect interest rates. The 10-year treasury bill is the driving force and often the federal funds rate and the mortgage interest rate based upon the 10-year treasury rate will not be in sync.

When there is high inflation, we need to compete with our government for cash and that causes the 10-year treasury yield to adjust forcing mortgage interest rates to increase or decrease. Should inflation decrease to any appreciable degree, mortgage interest rates will probably decline even when the federal funds rate does not.

Experts do not believe that interest rates will hit anywhere close to historic highs. You may see a slightly higher interest rate shortly as there are no signs yet that inflation is being tamed to the extent necessary for the FED to lower their short-term interest rate.

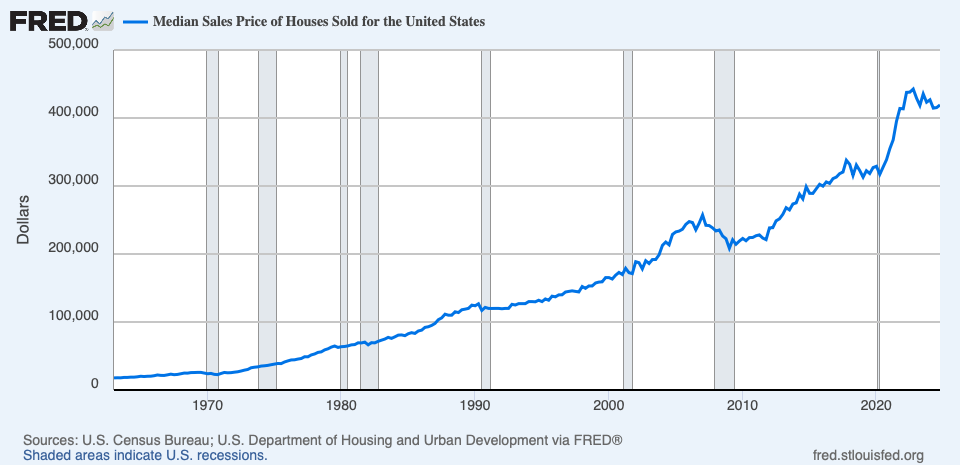

What fear of housing prices get some perspective?

Let's talk about your fear of housing prices. Start with ignoring articles about the "national average" housing prices going up or down. Your market is the only one you care about unless you are going to relocate and must sell first. Focus on those markets that directly affect your home price, either buying or selling.

The seller's market of the last few years is history almost everywhere. This does not mean that it is over in your market. I have done some research and found that many larger markets are experiencing degrees of pricing flexibility. What this means is that sellers are sitting on lots of equity and can afford to reduce their prices and/or provide concessions to buyers.

Buyers have opportunities to pay less

I want to focus on buyers not then I will get into sellers. Buyers can purchase a property in many areas now for less than they could if buying last year. Not all sellers yet understand the current market dynamics before they contact a real estate agent to list their home. Some will be stubborn and want to list at yesterday's high prices.

To clairify, there is no housing crash

There is a housing adjustment in process. Keep in mind that there is still a housing shortage. selling prices are softer and sellers are making deals but there is no crash in sight nor is there any rush to file bankrupsy and forclose. homeowners have lots of equity to work with

They will soon find they will be chasing down the price. During the 1991 housing crunch in California (yes there was a big one then as well as in 2009), I wanted to buy a new house. I listed my condo for sale without fully understanding that the market had just slid into a minor depression.

The price was posted at yesterday's value and I soon found that the price was too high. I lowered the price a bit and still no buyers. We were too slow to lower the price to a market rate so it did not sell. We lowered the price two more times to the point where I would be paying the buyer to take my property.

By holding on to the property, values came up in a few years

This was crazy so I removed the condo from the multiple listing service and decided to rent it. What a great move for me. I was able to make some money on the rent for about four years. By that time the market was higher than it was before I bought the property. I sold it and at the same time, we were buying yet another new home. We retained the home we moved out of and used that cash and the income from the condo to buy a bigger house.

The interest rate on that condo was 9% when we bought it. When we bought the next house it dropped to about 8%. Over the years, I bought and sold properties with interest rates probably averaging in the 7.5% range. Other people were buying and selling as well. Sorry for this slight detour but one reason for writing this article is to bring into perspective the cost of properties and interest rates.

There are two types of properties that I am weaving into this discussion. Primary residences and second homes. If you are looking for a primary residence, several points are critical in this economy to keep your monthly mortgage payment affordable.

Time to focus on reducing acquisition costs

Yes, the purchase price is important and I will get back to that shortly. I want to focus on those other costs which make up your monthly mortgage payments. Homeowners insurance, property taxes, and mortgage insurance plus homeowners association fees. All of these costs are calculated to determine your monthly obligation. These costs are used in the mortgage calculation of debt to income.

Remember, we are in a market now where interest rates are higher so how do you compensate for those higher rates? By getting better deals on everything you can. Starting with homeowners insurance. (read this article it will help you understand homeowners insurance).

I can tell you from experience as a real estate broker that there are times when a buyer fails to qualify to buy because the homeowner's insurance pushes them outside of the debt-to-income ratio. This is one reason to keep that cost as low as possible. Not all insurance brokers have the best deal. It's important to get rate quotes.

Insurance is just one area where you can save

Understand the type of insurance that the mortgage lender requires as a start. Some things are optional and others are not. Some limits are optional and others are not. Be sure that you have adequate coverage but not more than you need. Most insurance agents will sell you a policy based on what you tell them.

For example, if the value of all of your furnishings and items is worth $50,000 don't buy a policy for $100,000. Yes, you need replacement cost but not in excess. The insurance company will never pay you more than the policy permits regardless of how high the limit is. As mentioned above, read the article about insurance.

You can save big in insurance if you buy a new construction home or a house with a new or newer roof. Depending on the area where you live, the cost of insurance for an older roof can be as much as $2,000 per year. You must pay attention to the roof when you shop for a home. A new roof can cost upwards of $20,000 or more depending upon the type of roof and size of the house.

Association fees can be a deal killer

The way lenders calculate HOA fees is to add the cost to your total debt including mortgage payments to complete the debt-to-income ratio. If your HOA fees are $300 per month this amount is added to your total debt. Considering that the HOA fee includes some items that you would be required to pay for out of pocket, you would think the lender would consider this in their calculation.

You may not be able to buy a condo or townhome or even a house in an area with a high HOA fee if this fee pushes you out of the debt-to-income window. Even when as mentioned, most of the cost of the HOA includes some items that are included in the debt to income. Well, this is how it works so you have the decision to make.

I encourage anyone buying in an HOA to carefully consider the monthly fee against the benefits provided by that fee. Use the calculator below to determine the benefits before you decided to buy into an HOA.

Buyers can buy better

Ok, easy to say. Buyers can buy better. What does this mean? Select a home that meets your needs. This is not the time to buy a mansion or a house much larger or more expensive than you need. I am not suggesting that you lower your standards, just adjust expectations. Houses come in all sizes and prices. Pick one that you can qualify for and most important one that you can afford.

We are attempting here to put mortgage rates and housing rates into perspective.

Forget the idea that just because you have qualified to buy that $300,000 house you need to pay that much. Do you need a fourth bedroom or a third bathroom? If you do, perhaps choose a different house. This is not the time to over-obligate. Be prudent, and consider the consequences if you lose your job or your spouse decides to stop working.

Investors must work the numbers. Zero emotion should be included in the decision to buy. Either the rents applied against costs produce a profit or they don't. This does not mean that you can't raise rents on a property that you are rehabbing. Be a bit more conservative now. There will be a time to take greater risks when the market starts turning.

Understand how a lower price can affect your payment

It's time to negotiate with sellers. Some sellers know that the market is turning and some are not aware. It's time to consider buying your house and paying less for it. Make an offer that you and your real estate agent believe is realistic based on the most current market data. If you try to overpay the appraiser may bring you back to earth. The same is true for sellers asking too much.

Take a look at the chart below which indicates how much you will save in monthly mortgage payments based on negotiating a lower buying price. Note that with a price reduction of just 10% from the selling price, you could save $143.89 per month. That's not all you save, remember that insurance policy? It's based partly upon the value of the house (rebuild cost will not change). Property taxes are usually based on the selling price and may drop with a lower buying price.

Check with your real estate agent, that agent will be able to obtain data on the average reduction between the list price and the selling price. This information will help in negotiations. Most sellers build something into the price to negotiate. That amount may start at the average price reduction in the area.

10% reduction in price = 1% reduction in interest rate

Based upon the chart above, reducing the buying price by 10%, a savings of $143.89 per month is the equivalent of reducing the interest rate to 5%. This is a full one percent reduction in the interest rate. If you were concerned about higher interest rates, buying right will help you get that payment down. It's all about the dollars that come from your bank account to the mortgage, insurance, and tax agencies.

This is why negotiating is such an important step in this economy. You can help beat the recent run-up in housing costs. Get that price to a workable number and go for it.

Next, apply that better interest rate that you have negotiated to the lower house price and those lower closing costs. All will add up to a final monthly payment that you can afford. This is how the experts buy property. Speaking of experts buying property, investors should do the same as I have recommended above. Buying rights is one of two effective mitigation strategies for higher interest rates. The second item is of course raising rents to market or above.

This is why you put Mortgage Rates & Housing Prices in Perspective

Don't be concerned that mortgage rates and housing prices will prevent you from buying a house or an investment property. There are always deals out there. Remember, you can always buy a house that requires some work which will help you negotiate a better buying price.

Sellers often fail to repair their properties before they put them on the market. A buyer comes along and either wants a lower buying price or some assistance with closing costs so they can use the savings to make repairs.

I tell sellers all the time that they should maintain their houses and make minor repairs before they list the house. The basic reason is that buyers don't have a good estimate for repairs, they guess and their guesses are almost always high.

For example, as a buyer, you find a broken window in the house you want to buy. You offer $1,000 less than the asking price because of the broken window. The seller should have repaired the window because the cost is only $300 from a local vendor. Now the seller is faced with offering $1,000 and they do.

Use any items that need to be repaired as a negotiating point

You want to buy this fixer house because you think you can save $50,000 from the selling price. You have a friend who is a contractor who tells you that you can rehab the house for about $20,000 and do most of the work yourself. The seller knows that the house needs work and is probably prepared psychologically to reduce the price somewhat.

If you are willing to move into a house that needs work, you may be able to find a good deal or deals if you are an investor. It's amazing to me how many sellers don't maintain their houses and will lose money on a sale just to "get rid of it". Sometimes the sellers don't have the funds to make the repairs.

I was working with some investors who wanted to buy a house. They made an offer and asked the seller to replace the roof. The seller would have done this but he had no money. Unfortunately, the house was being financed with an FHA loan, and without a new roof, it would not qualify. Bad for both parties.

Time to get started

If you are ready to move on to buying a primary residence or an investment property, use the information provided above. Work with your real estate agent to understand the market for housing prices. Meet with and create a financing package that will work for you using our calculators. Remember to negotiate your rate.

If you find that the financing is challenging now, set a date when you believe you will be ready. Work on the things discussed here, and move the needle up on your credit report. This and cash in the bank is your strengths.

Sellers, I have not forgotten you. All of that equity built up, if you were thinking of selling, this is the time. Capitalize on that equity by selling your house while it is still near the top of the market. Remember that there is downward pressure on prices so be prepared to negotiate with a buyer. Work with your listing agent to set a fair price to avoid stress and the exchange of counter offers.

Sellers should repair their houses before offering them for sale

I mentioned this above, it's very important if you want to earn as much as possible from your house. This does not mean replacing the kitchen or the flooring or even the roof if these things are in serviceable condition. Think about curb appeal. Work on the exterior of your home to make it look inviting. Touch up paint inside and clean the walls around light switches.

The kitchen must be pristine. Bring in a cleaning crew if necessary to clean your house and that stove. Don't forget the AC closet. Clean houses get better offers. Repair broken windows and any safety issues e.g. broken spindles on stairs. Replace rotted wood around soffits and other areas.

Fix all leaks and clean up around them. Air out your house, get that musty smell out. Buy an ozone generator to accomplish this. Remember, if something will cost you $50 to fix and you fail to do it, a buyer will want $100 or more to do it after closing.

Consider becoming an investor

Owners can decide to retain their property and rent it. Sellers can use some of the equity in their home to buy a new home and an investment property. Investors can buy in this market using the techniques discussed above. If you want to become successful as an investor, take one or more of KEYLADDER's education courses by clicking the button below. There are two free mini-courses available.

Please read our other blog articles at KEYLADDER.COM.

Listen to our podcasts listed on the menu and watch our Youtube Videos. KEYLADDER hears to help you become a better investor. Anytime is a good time to start investing particularly when you have learned how by taking one of our courses.